2024 Form 1040 Schedule B Instructions And

2024 Form 1040 Schedule B Instructions And – The 1040 2023 Instructions instruct transferred it during 2023 must use Form 8949, Sales and other Dispositions of Capital Assets, to figure their capital gain or loss on the transaction and then . Stay informed about U.S. taxation for the year 2023. Learn about Form 1040, Schedules, filing deadlines, and essential instructions. Ensure a smooth tax season. .

2024 Form 1040 Schedule B Instructions And

Source : www.irs.govForm 1040 for IRS 2024 ~ What is it? Schedule A B C D Instructions

Source : www.incometaxgujarat.org1040 (2023) | Internal Revenue Service

Source : www.irs.govIrs Schedule B for 2018 2024 Form Fill Out and Sign Printable

Source : www.signnow.com1040 (2023) | Internal Revenue Service

Source : www.irs.govForm 1040 for IRS 2024 ~ What is it? Schedule A B C D Instructions

Source : www.incometaxgujarat.orgAll About Schedule A (Form 1040 or 1040 SR): Itemized Deductions

Source : www.investopedia.com2023 Instructions for Schedule B

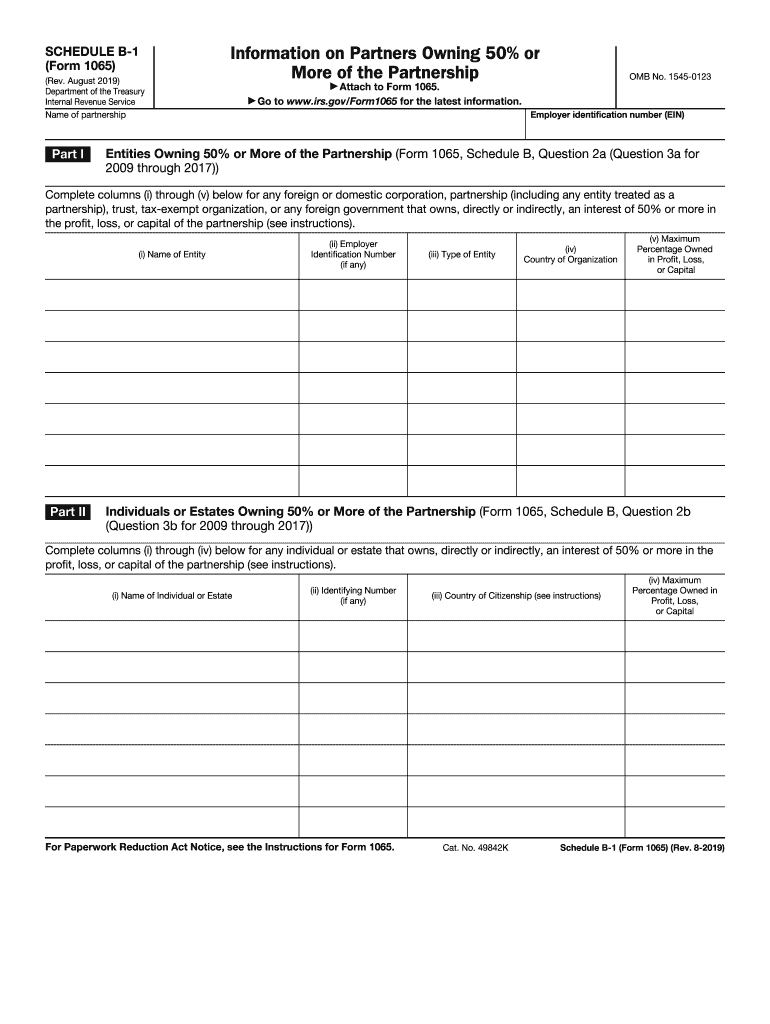

Source : www.irs.gov2019 2024 Form IRS 1065 Schedule B 1 Fill Online, Printable

Source : form-1065-schedule-b-1.pdffiller.com2023 Form 1040 SR

Source : www.irs.gov2024 Form 1040 Schedule B Instructions And 1040 (2023) | Internal Revenue Service: The Internal Revenue Service (IRS) has recently released the updated Schedule 1 tax form and instructions for the are not listed on the standard Form 1040. It includes sections for reporting . If you are a sole proprietor, you report your business profit or loss on Internal Revenue Service Schedule C of Form 1040, Profit or Loss of the loss on Section B of Form 4684. .

]]>

:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)